See This Report about Financial Advisor Fees

Wiki Article

The Best Strategy To Use For Financial Advisor Meaning

Table of ContentsThe Best Strategy To Use For Financial Advisor RatingsFinancial Advisor Ratings for BeginnersThe 20-Second Trick For Financial AdvisorThe Greatest Guide To Financial Advisor Meaning

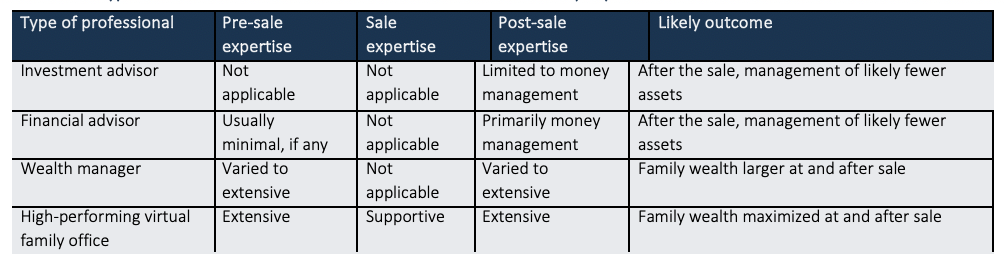

There are a number of kinds of financial advisors around, each with differing credentials, specializeds, as well as levels of accountability. And when you're on the quest for a professional fit to your needs, it's not unusual to ask, "How do I know which monetary advisor is best for me?" The solution starts with a truthful accounting of your needs as well as a bit of research.Kinds of Financial Advisors to Take Into Consideration Depending on your economic requirements, you might decide for a generalised or specialized economic consultant. As you begin to dive right into the world of looking for out a financial advisor that fits your requirements, you will likely be offered with lots of titles leaving you questioning if you are getting in touch with the right person.

It is vital to note that some financial advisors likewise have broker licenses (significance they can offer protections), yet they are not solely brokers. On the same note, brokers are not all certified just as and also are not economic consultants. This is simply one of the lots of reasons it is best to begin with a qualified economic organizer who can suggest you on your investments and also retirement.

Advisors Financial Asheboro Nc Fundamentals Explained

Unlike investment advisors, brokers are not paid straight by clients, rather, they earn compensations for trading stocks and also bonds, and for offering mutual funds as well as various other items.

You can typically inform an expert's specialty from his or her monetary accreditations. A certified estate coordinator (AEP) is a consultant that specializes in estate preparation. When you're looking for an economic expert, it's good to have a suggestion what you desire assistance with. It's additionally worth mentioning monetary organizers. financial advisor.

Much like "monetary consultant," "economic coordinator" is also a broad term. Regardless of your details requirements and economic circumstance, one requirements you must highly consider is whether a possible consultant is a fiduciary.

Some Of Financial Advisor Certifications

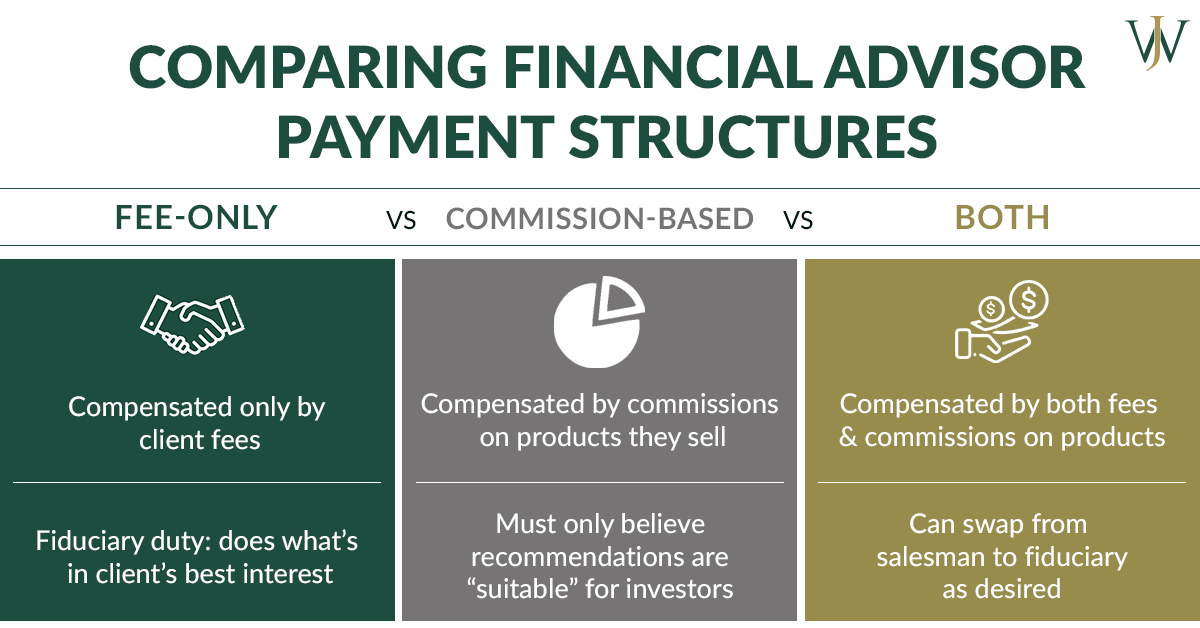

To shield on your own from someone who is just attempting to get more money from you, it's a great suggestion to seek a consultant who is registered as a fiduciary. A financial advisor that is registered as a fiduciary is called for, by law, to act in the very best passions of a client.Fiduciaries can only recommend you to use such products if they assume it's really the very best financial choice for you to do so. The United State Stocks as well as Exchange Compensation (SEC) manages fiduciaries. Fiduciaries who look at these guys fall short to act in a customer's benefits can be hit with penalties and/or jail time of up to one decade.

That isn't due to the fact that any person can obtain them. Receiving either certification needs somebody to experience a variety of classes and examinations, along with earning a collection quantity of hands-on experience. The outcome of the qualification process is that CFPs and Ch, FCs are skilled in topics throughout the field of individual financing.

The fee can be 1. 5% for Read Full Report AUM between $0 and also $1 million, yet 1% for all possessions over $1 million. Charges normally decrease as AUM boosts. A consultant that generates income exclusively from this management fee is a fee-only advisor. The choice is a fee-based consultant. They appear similar, however there's a crucial distinction.

What Does Financial Advisor License Mean?

As an example, a consultant's monitoring fee might or may not cover the costs associated with trading securities. Some experts additionally bill an established fee per deal. See to it you comprehend any as well as all of the fees an expert charges. You don't desire to place all of your cash under their control only to take care of concealed surprises later.

This is a service where the advisor will bundle all account monitoring expenses, including trading costs and cost ratios, into one comprehensive fee. Because this cost covers a lot more, it is typically greater than a cost that only includes monitoring and also excludes things article source like trading prices. Wrap charges are appealing for their simplicity but additionally aren't worth the price for every person.

While a traditional expert usually bills a cost in between 1% and also 2% of AUM, the cost for a robo-advisor is typically 0. The huge trade-off with a robo-advisor is that you frequently do not have the capacity to speak with a human advisor.

Report this wiki page